Do your future buyers know who you are?

Investing in brand awareness is an investment in future recall and recognition. When buyers need your solution, they’re more likely to remember your brand, which helps to ensure you’re on their shortlist from the start.

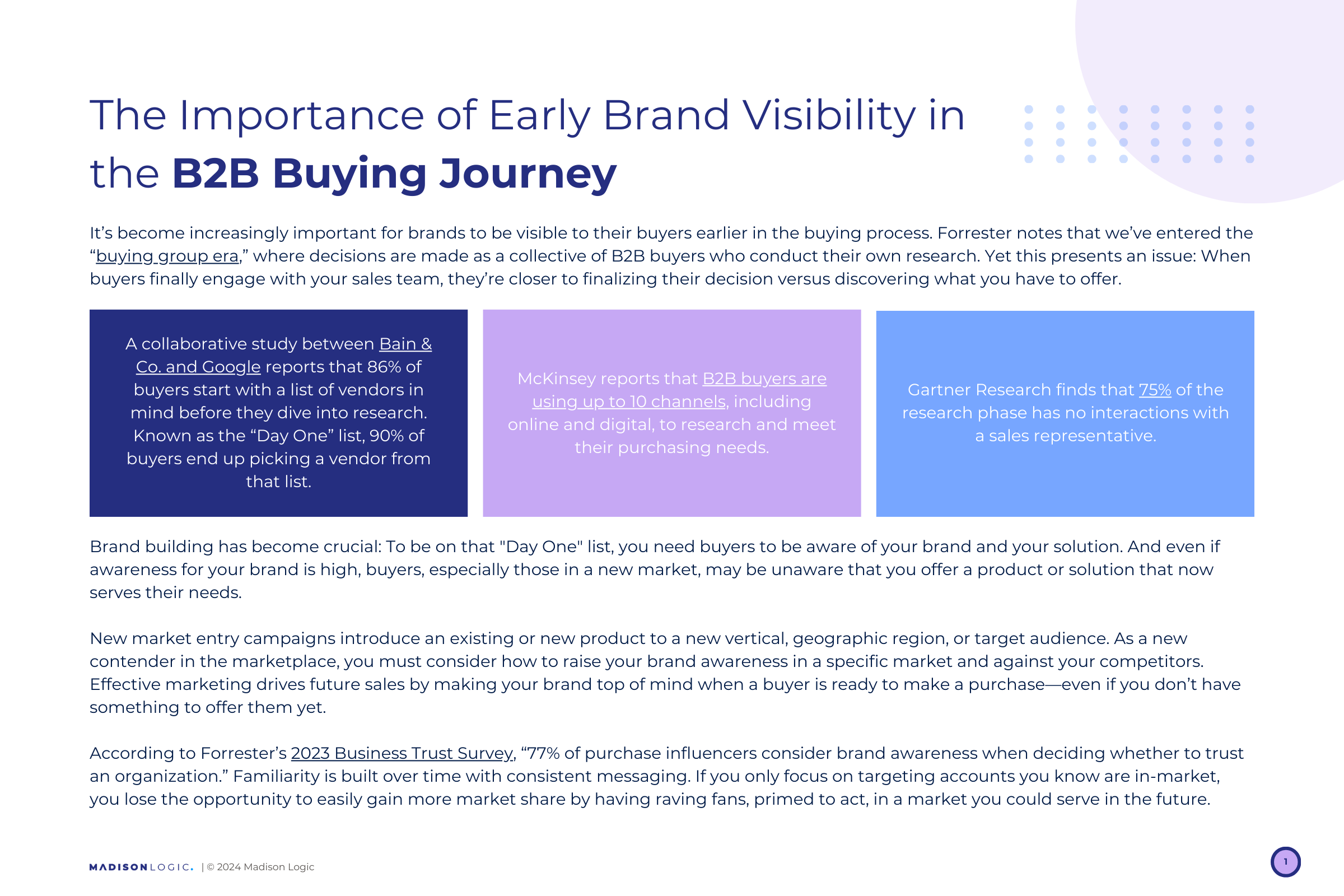

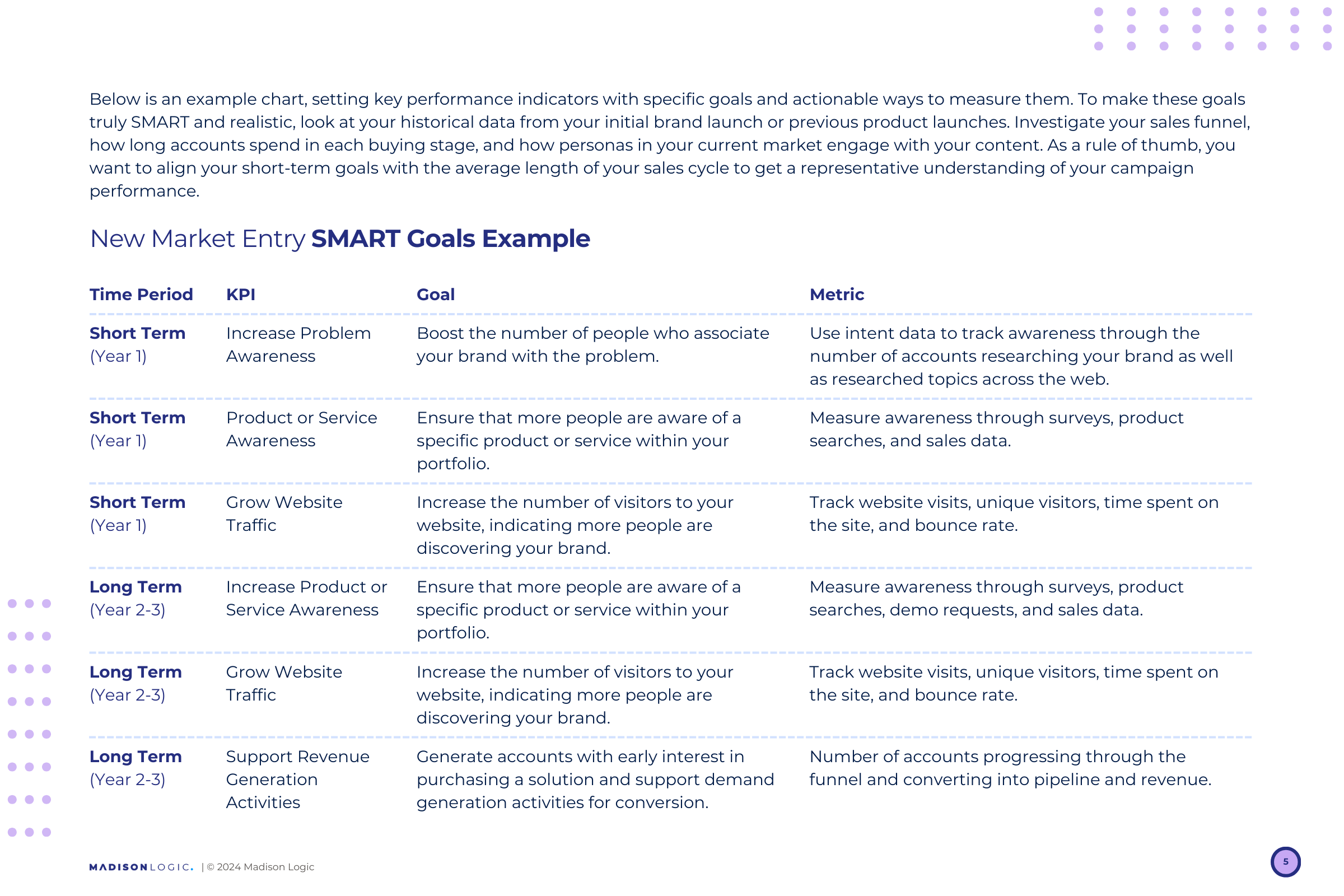

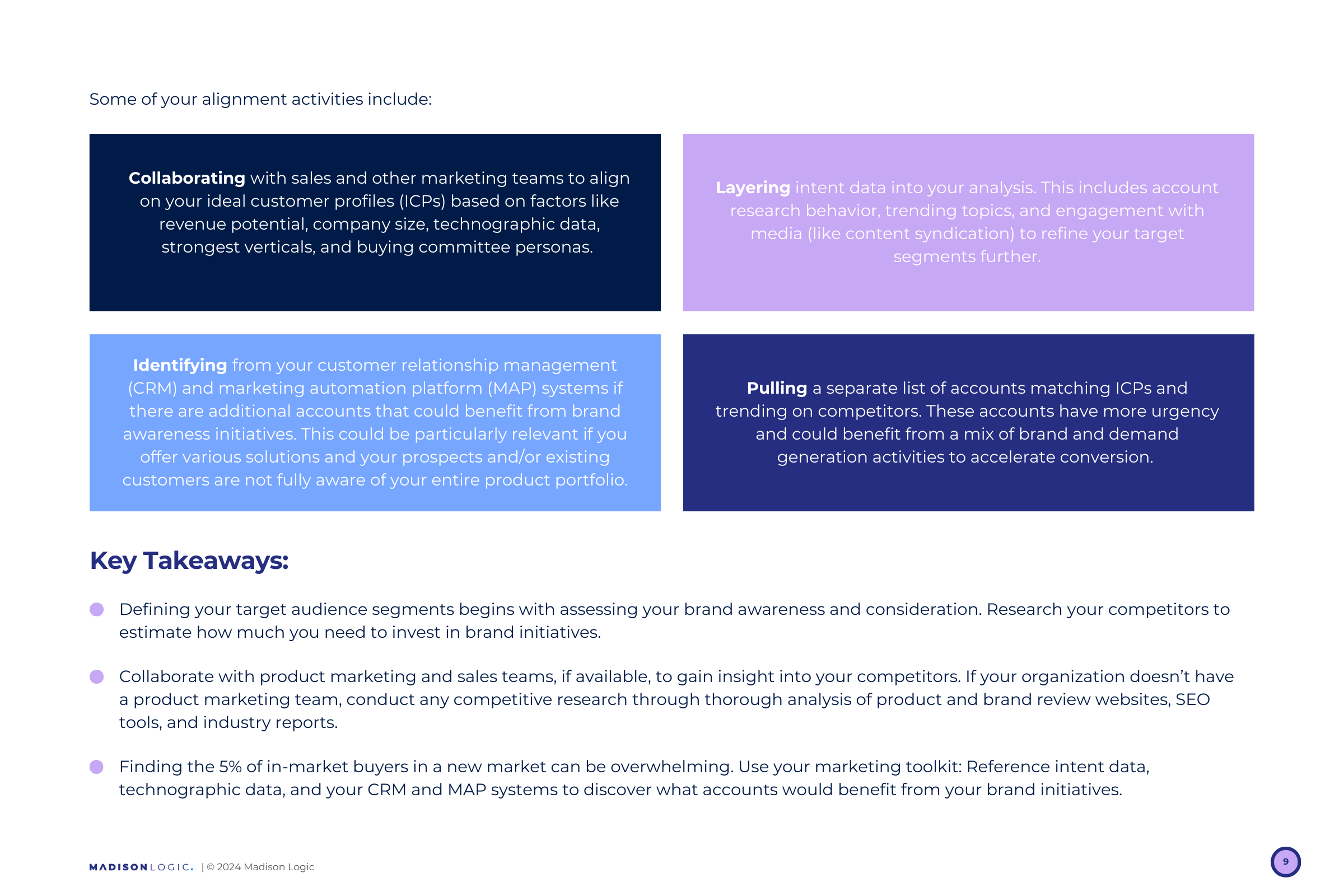

As a new contender in the marketplace, you must consider how to raise your brand awareness in a specific market and against your competitors. Effective marketing drives future sales by making your brand top-of-mind when a buyer is ready to make a purchase—even if you don’t have something to offer them yet. However, building brand awareness requires significant resources, and misallocating those resources can lead to wasted budgets and missed opportunities if the effort doesn’t resonate with the target market.

This actionable Blueprint helps you quickly navigate new market entry with an account-based marketing (ABM) approach that allows you to focus on educating your buyers, driving urgency, and optimizing your campaigns to ensure buyers receive a unified, consistent experience from initial encounter with your brand to a long partnership with ample expansion opportunities.

In it, you’ll learn: