New! Expand your reach and drive real demand with ABM Audio Advertising. Learn More

Understanding key performance drivers is essential for any account-based marketing (ABM) strategy but is especially important to keep a pulse on your customer expansion initiatives. Once an account buys your product or even multiple products, you want to ensure they continuously see value—which means you need to continue to nurture and grow the partnership.

Measuring campaign performance isn’t just about converting accounts to invest more in your offerings, though. Alongside keeping your eye on market conditions (as they impact the customer cycle), it’s important to measure the success of your ABM customer expansion activities so you can optimize campaigns to ensure your customer relationships are set to flourish from initial onboarding to expansion.

Contrary to popular belief that existing client relationships belong to sales and post-sales teams, successful customer expansion strategies begin with the marketing team, as they have access to intent data that demonstrates what accounts are thinking about before they even communicate it to their sales representative or customer success manager. Marketers need to ensure sales and customer success teams have a deep understanding of accounts’ actions and access to real-time data so they can proactively support and make campaign optimizations that affect current customers showing interest in expansion. Here’s how you can build the foundation to measure and optimize these expansion activities so that you can quickly craft a narrative that benefits both your customers’ success as they continue to grow with you, and your company’s revenue goals.

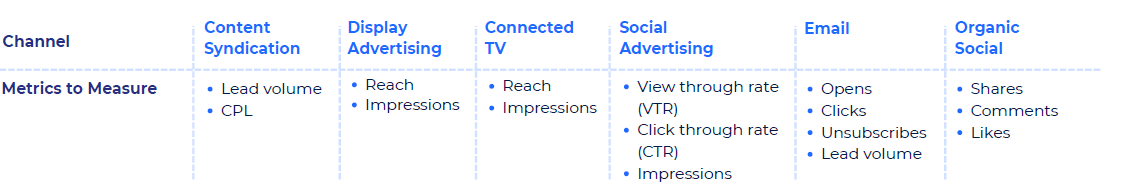

For B2B businesses, you must always be where your customers are, as their activities provide insights into their needs and concerns before they bring them to the customer success team. Marketers need to set key performance indicators (KPIs) that clearly demonstrate they understand how customers engage with marketing channels and how optimizations per channel impact the campaigns’ overall success.

A full customer expansion campaign readout requires ongoing evaluation and reporting. Ideally, you measure each program and determine its success per its specific KPIs, then gather your findings into a monthly report and analyze the results. Your insights should be driven by how all the channel activities tie together across the campaign, which channels attract the most responsive leads, and how these channels impact your lead scoring in terms of your expansion efforts.

Reporting isn’t just about how KPIs determine success. High-quality campaign reports require diving deeper into your data to determine how each channel and expansion campaign impact expansion pipeline and expansion revenue. While your KPIs tie into your overall company goals, your metrics are the data points that you analyze to determine how your campaign objectives are performing. Think of your metrics as your facts, your foundation in putting together a data-driven narrative around your ABM engagement efforts.

As converting existing customers costs five times less than gaining new customers, you want to have as much clarity around how each KPI and metric serve in proving the strength of your multi-channel marketing strategy, especially as you aim to have higher quality interactions with your customer base.

Success with your outbound initiatives, such as your display advertising program, will look different from an owned channel like email. You need to constantly evaluate your marketing mix channel strategy to ensure your ABM content and messaging is up to date, whether it’s with updated pricing or product functionality. And since each channel has specific KPIs, due to industry benchmarks or individual platform algorithms (like LinkedIn), you need to deeply understand how each program impacts the overall health and success of your expansion campaigns.

Here’s why each metric ties to a specific channel, and how they help you improve your channel efficiency:

For customer expansion campaigns, you need to track expansion and retention metrics to understand your customer base’s health. This helps you keep a pulse on customer experience, from their initial excitement around your brand to the onboarding experience to their satisfaction with product usage and how it impacts their business. When you quickly identify the metrics that matter to your business, and how they impact your company’s overall health, you can better identify accounts’ actions that signal they’re ready to engage with your upsell and cross-sell campaigns.

Ideally, your enterprise resource planning (ERP) system, customer relationship manager (CRM), and marketing automation platform (MAP) are already integrated into a system that you can holistically view in real time. You need to be able to quickly pull up an account’s entire customer journey, from onboarding to expansion and customer retention, so that sales, marketing, and customer success managers (CSMs) can understand their roles in customer expansion campaigns. And the faster you can pinpoint when you discovered a cross-sell or upsell opportunity, identified who you targeted within the account, what content and channels were used, and what content converted the account, the more proactive and efficient your optimization efforts become.

You need to identify the metrics that provide a clear narrative of current customer satisfaction and pave the way for more proactive optimizations. The ending, so to speak, around these optimizations is how you will move forward with your expansion and retention efforts, which can mean changes in budget and department goals. You may need to develop different types of content and find opportunities to experiment with that type of content in your campaigns. And, of course, you need to tie everything to the company’s bottom line and retention goals.

Here are the metrics you can immediately dial into that will pave the way for your data-driven narrative:

CLV helps you determine a timeline for positive return on investment (ROI) across your accounts. Customer acquisition costs (CAC) may vary depending on the speed of the sales cycle, which will impact your CLV per customer. The more customers purchase across their customer lifetime, the greater their lifetime value. CLV also impacts your ideal customer profile (ICP) and boosts your customer loyalty initiatives.

As many B2B businesses work on yearly or multi-year contracts, you want to understand an account’s terms so that you know what products or tier they have now, and where there are opportunities to grow. You’ll also be able to determine a timeline for any expansion initiatives, as you can estimate when the account will complete onboarding and ramp up their product usage. ACV also impacts your CLV, as ACV determines payment schedule and varies based on what accounts end up purchasing. ACV also ties into larger retention metrics, as the C–suite will want to understand how marketing can help pursue an increase in annual recurring revenue (ARR) and expansion monthly recurring revenue (expansion MRR), since expansions include buying additional features, a higher tier access, or additional products.

Net revenue retention (NRR) gives insight into how much revenue the company has gained from customers over a specific time period. This can be particularly useful around product launches, as you can dive into the specific launch campaign, determine where you were successful, and determine what content customers need to convert. As a revenue growth metric, NRR can also help you determine where you’ve gained and lost value with customers across your customer expansion initiatives, especially in periods where there may be economic uncertainty or booms.

Your NPS or CSAT is indicative of customer satisfaction and loyalty, especially in determining the likelihood of customers recommending your product to others. Your NPS or CSAT is determined through a series of customer feedback surveys with questions that can only be answered on a 0-10 scale, which will give you a sense of customer health at specific intervals, which you can then analyze on a trend between surveys and year over year. While NPS offers a number ranging from negative 100 to positive 100, your CSAT will offer a score as a percentage, with 100% as fantastic while a zero means there could be some churn risk. Segmenting by where accounts score will also show you who can potentially offer some referrals for other buyer groups. You can also segment responses based on what product verticals or tiers you offer to determine the success of any expansion campaigns as accounts engage with more of your offerings.

Tracking and evaluating the timeline for all cross-sell and upsell opportunities created, won, and loss helps you predict when these opportunities may come up across similar customer accounts. You can gain deeper insights into why the opportunities arose and what the final decision was by digging into your intent data, as well as considering buyer personas, industry, company size, and competitor involvement to make deeper, actionable optimizations around your campaigns. You can also help flag signs of potential customer churn and lost opportunities as you look into what accounts may be searching. If they’re looking at a competitor’s offering, you need to strike with an expansion and nurture campaign that shows your product can offer the solution for what they need.

Outside of categorizing metrics as purely expansion and retention, you also want to consider the role metrics play in helping you thread your customer expansion strategy together. Consider these four categories:

Keep in mind that cross-sell and upsell campaigns appeal to particular emotions—the “fear of missing out” for cross-sell campaigns and the recognition of growth and success with the product for upsell campaigns—you want to ensure that the metrics for each expansion campaign speak to those concerns. Your engagement metrics may look different, for example. For cross-sell campaigns, you would pay more attention to new contacts identified within the targeted customer account and track their actions. For an upsell campaign, you should look deeper into the existing buying group’s attendance at webinars or events that foster a sense of community and growth.

You’ll also want to pay attention to social proof across the board: As customers share their success stories and testimonials on review sites or their own social media profiles, you can take that as a signal of the success of the client relationship thus far and where you can continue to grow the relationship (especially with a new or other expansion opportunity).

Conversation is a continuous driver through every step for an expansion campaign—so it’s not surprise that to successfully measure and optimize your expansion campaigns and strategies, you must set up regular meetings with your sales and customer success teams to report on customer and campaign health.

Discuss what content drives the most engagement, as well as what content may need to be refreshed to speak to current market conditions. These discussions fuel whether you’ll need to make any adjustments to your nurture strategies, from who you’re targeting and what you’re using to reinforce your brand as the partner of choice.

Track your marketing and sales efforts on an ongoing basis and review your results with the customer success team. Together, you want to discover how your activities and distribution methods impact your campaigns and where you can become more efficient with your efforts. Activities include:

ABM-driven campaigns always put the account front and center: you want to quickly identify who is part of the buying committee so you can deliver the right content at the right time. Customer expansion campaigns don’t need to rely on building as much brand awareness, as the buying group already has some familiarity with your brand. Whether it’s a cross-sell to a new buying group within the account or an upsell within your existing buying group, prioritize the buyer persona that can act as your brand champion. That way, you can deliver the content and messaging they need to get other decision-makers to see you as their partner of choice.

Conversations with sales and customer success will quickly identify who brand advocates were at the start of the partnership. Yet buying committees can quickly change as members leave their jobs or change roles, or companies change their overall structure as they experience growth or loss stages. Marketers can review intent and engagement data, such as the number of downloads, time spent on the website, and webinar attendance to also identify who may emerge as other brand advocates. This is especially important with cross-sell initiatives, as you’ll target a new buying group within the existing account.

Customer feedback surveys and social activities also play an important role in identifying your brand advocates. Look at who is engaging with your brand profiles and posts, as well as who leaves raving reviews in feedback surveys. These are the buyers who will engage with the rest of the buying committee to advocate for your product as the one that will help them achieve their goals. Approach them for referrals, whether it’s for another buying group within the account or someone from their network at another company.

Make sure to review your advocates on a consistent basis, so you can consider their personas and optimize your expansion efforts around similar demographics.

A successful customer expansion strategy takes cross-collaboration seriously. With signals coming from accounts’ engagement activities on the internet to their conversations with CSMs, marketers, sales, and customer success managers need to quickly be on the same page, prepared with information to proactively pursue cross-sell and upsell opportunities.

While your CRM and MAP systems store vital account information that will aid in your customer expansion campaigns’ successes, you need to be able to trust that the view in front of you is up to date with real-time data. Losing time to reconcile data could spell the difference between opportunities won and opportunities lost, alongside diminishing the customer experience to help customers get optimal results with your product.

Madison Logic brings your CRM and MAP data into a single, holistic view so you can quickly identify your brand advocates, trace actions across the account, and dive into intent signals. With ML Measurement, you can track cross-channel performance, account engagement, and pipeline and revenue impact so that you can focus on crafting a customer expansion experience that keeps your key metrics top of mind while balancing customer needs and expectations with your product. ML Insights also keeps account scores, based on real-time intent data from over 20 million companies and proprietary engagement data, which will give you a better sense of what content matches the personas you’re targeting.

ABM measurement and optimization is a continuous process. Download the Customer Expansion: ABM for Cross-Selling and Upselling Blueprint to learn how you can create a stronger, account-centered customer expansion strategy. You can also watch our ABM for Customer Expansion virtual event to hear from our experts about their experience with an ABM approach to customer expansion. If you’re ready to learn how an ABM marketing strategy impacts the entire sales funnel, request a demo today.